NLP & Regression on SP500 Companies

Does a popular NLP model, LDA, applied to earnings transcript provide valuable information beyond those from common financial indicators?

Note: After implementing this notebook, I tried to trim down a little bit. Thus, I have removed some unnecessary cells

from bs4 import BeautifulSoup

import pandas as pd

import requests

import re

from selenium import webdriver

from selenium.webdriver.common.keys import Keys

import time

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.base import BaseEstimator, TransformerMixin

from sklearn.linear_model import Ridge

from sklearn.preprocessing import StandardScaler

from sklearn.preprocessing import MinMaxScaler

from sklearn.pipeline import make_pipeline

from sklearn.decomposition import TruncatedSVD

from sklearn.linear_model import LinearRegression, Lasso, LassoCV, Ridge, RidgeCV

from sklearn.decomposition import LatentDirichletAllocation

from sklearn.feature_extraction.text import CountVectorizer

from sklearn.model_selection import train_test_split

from sklearn.pipeline import FeatureUnion

from collections import defaultdict

from selenium import webdriver

from selenium.webdriver.common.keys import Keys

import pickle

import os

chromedriver = "/Applications/chromedriver" # path to the chromedriver executable

os.environ["webdriver.chrome.driver"] = chromedriver

1. Scraping data

1.1 Scraping company symbol

Let’s scrape SP500 company information from wikipedia

sp_url = 'https://en.wikipedia.org/wiki/List_of_S%26P_500_companies'

sp = pd.read_html(sp_url, header=0)[0]

sp.head()

| Security | Symbol | SEC filings | GICS Sector | GICS Sub Industry | Headquarters Location | Date first added | CIK | Founded | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 3M Company | MMM | reports | Industrials | Industrial Conglomerates | St. Paul, Minnesota | NaN | 66740 | 1902 |

| 1 | Abbott Laboratories | ABT | reports | Health Care | Health Care Equipment | North Chicago, Illinois | 1964-03-31 | 1800 | 1888 |

| 2 | AbbVie Inc. | ABBV | reports | Health Care | Pharmaceuticals | North Chicago, Illinois | 2012-12-31 | 1551152 | 2013 (1888) |

| 3 | ABIOMED Inc | ABMD | reports | Health Care | Health Care Equipment | Danvers, Massachusetts | 2018-05-31 | 815094 | 1981 |

| 4 | Accenture plc | ACN | reports | Information Technology | IT Consulting & Other Services | Dublin, Ireland | 2011-07-06 | 1467373 | 1989 |

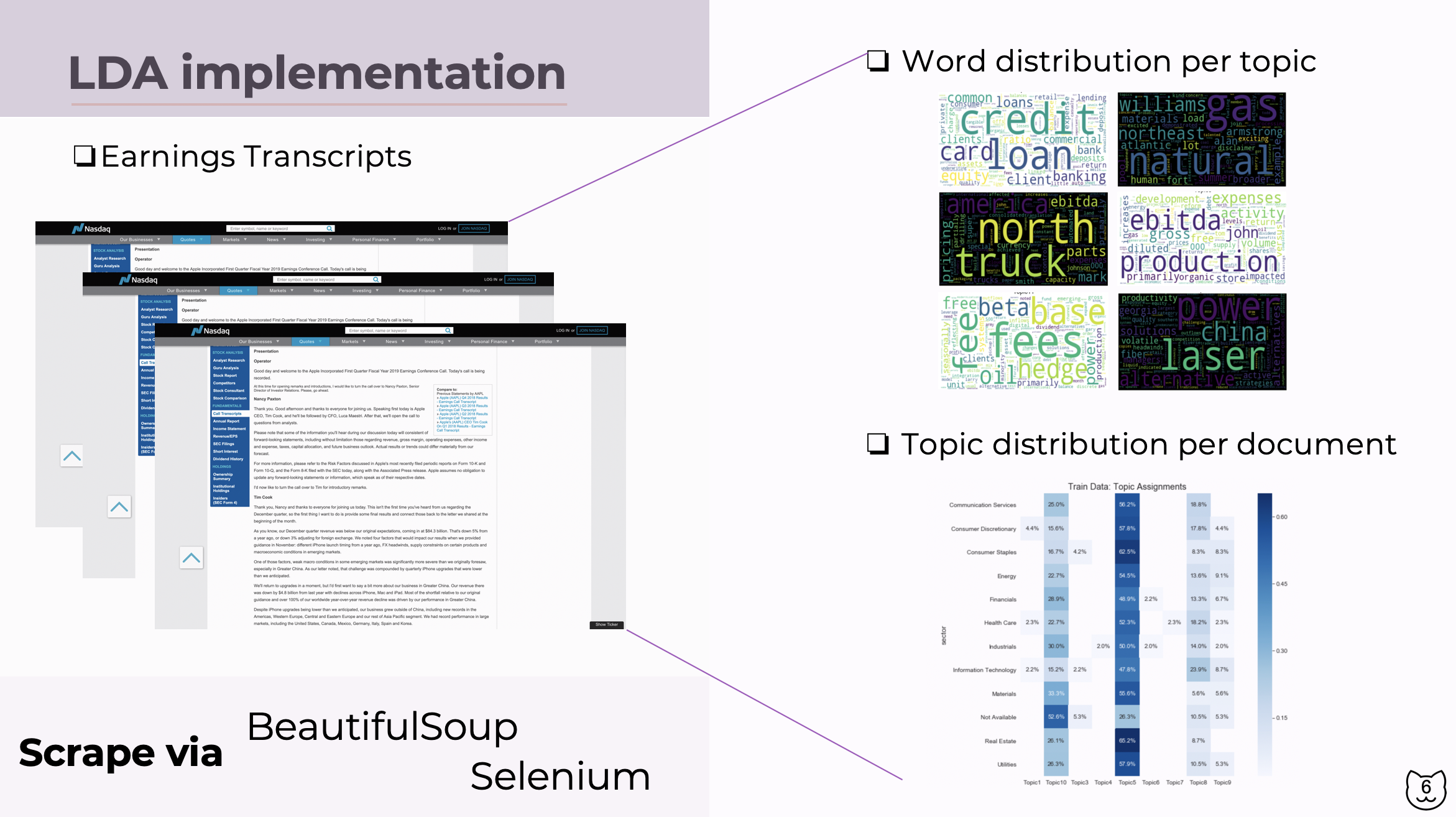

1.2 Scraping Earnings Transcripts from Nasdaq

Scrape earnings transcript from SP500 companies. Activate # to scrape pages that dynmically load from javascript. However, another problem was encountered; that was, the captcha. Thus, I ignored the dynamic pages

my_dict = defaultdict(str)

#BRK.B, CPRI, SCHW have no earnings call transcript for Q3 2018

SYMBOLS = sp['Symbol'].drop([71,90,105])

cnt=0

captcha=[]

captcha2=[]

for symbol in SYMBOLS:

url_path = f'https://www.nasdaq.com/symbol/{symbol}/call-transcripts'

response = requests.get(url_path)

soup = BeautifulSoup(response.text,'lxml')

query = re.compile('Q3 2018')

if not soup.find(text=query):

# If page is dynamically loading from javascript, I couldn't locate href. Then, use selenium

# to obtain rendered page

alter_url=f'https://seekingalpha.com/symbol/{symbol}/earnings/transcripts'

# driver = webdriver.Chrome(chromedriver)

# driver.get(url_path)

# soup = BeautifulSoup(driver.page_source,'lxml')

# soup.find_all('a')

response = requests.get(alter_url)

soup = BeautifulSoup(response.text,'lxml')

if soup.find(text=re.compile('captcha')) != None:

captcha.append(symbol)

continue

aug_path = soup.find(text=query).find_parent()['href']

call_url = f'https://seekingalpha.com'+aug_path

call_response = requests.get(call_url)

soup = BeautifulSoup(call_response.text,'lxml')

if soup.find(text=re.compile('captcha')) != None:

captcha2.append(symbol)

continue

raw_transcript = [item.text for item in soup.find(text=query).find_parent().find_parent().find_parent().find_all('p')]

raw_transcript=raw_transcript[raw_transcript.index('')+1:]

raw_transcript=''.join(raw_transcript)

else:

unrefined_string = soup.find(text=query).find_parents('span')

aug_path = unrefined_string[0].find('a')['href']

call_url = f'http://www.nasdaq.com'+aug_path

call_response = requests.get(call_url)

soup = BeautifulSoup(call_response.text,'lxml')

raw_transcript = [item.text for item in soup.find(text=query).find_parent().find_parent().find_parent().find_all('p')]

raw_transcript=''.join(raw_transcript)

if raw_transcript.find('Operator') != -1:

raw_transcript=raw_transcript[raw_transcript.find('Operator')+8:]

else:

raw_transcript=raw_transcript[raw_transcript.find('Presentation')+5:]

exec(f'my_dict["{symbol}"] += raw_transcript[:raw_transcript.find("Read the rest of")]')

cnt+=1

if cnt%10 ==0: print(f"{cnt} companies' transcript read")

480 companies' transcript read

The list of companies filtered by Captcha were as following

print(captcha, captcha2)

['GOOGL', 'CNP', 'CTAS', 'CSCO', 'ED', 'DISCA', 'DOW', 'EXPD', 'JEF', 'LLL', 'LIN', 'MDT', 'MU', 'MSFT', 'NWS', 'PGR', 'CRM', 'TROW', 'FOX', 'UA', 'WMT'] []

The list of transcripts are as following

my_dict

defaultdict(str,

{'MMM': "I would now like to turn the call over to Bruce Jermeland, Director of Investor Relations at 3M.Bruce JermelandThank you and good morning, everyone. Welcome to our third quarter 2018 business review. With me today are Mike Roman, 3M's Chief Executive Officer; and Nick Gangestad, our Chief Financial Officer. Mike and Nick will make some formal comments, and then we'll take your questions. Please note that today's earnings release and slide presentations accompanying this call are posted on our Investor Relations website at 3m.com under the heading Quarterly Earnings.Before we begin, let me remind you of the dates for our upcoming investor events found on Slide 2. First, we will be hosting our Investor Day at your headquarters in St. Paul, Minnesota in a few weeks with a welcome reception in the evening of Wednesday, November 14th where we will be highlighting how 3M Science is advancing our priority markets for growth. Along with the formal presentation program, on Thursday November 15, the presentations will discuss our new five-year plan along with our preview of our 2019 outlook. If you plan to attend the event and have not yet responded, please RSVP right away. Second, our Q4 Earnings Conference call will take place on Tuesday, January 29, 2019.Please take a moment to read the forward-looking statement on Slide 3. During today's conference call, we will make certain predictive statements that reflect our current views about 3M's future performance and financial results. These statements are based on certain assumptions and expectations of future events that are subject to risks and uncertainties. Item 1A of our most recent Form 10-K lists some of the most important risk factors that could cause actual results to differ from our predictions.Please note that throughout today's presentation, we'll be making references to certain non-GAAP financial measures. Reconciliations of the non-GAAP measures can be found in the appendices of today's presentation and press release. Please turn to Slide 4 and I'll hand out to Mike. Mike?Mike RomanThank you, Bruce. Good morning, everyone and thank you, for joining us. In the third quarter 3M delivered a double-digit increase and cash flow and earnings per share along with strong margins despite slower growth. We also continue to execute on business transformation or deploying capital to invest in our future and return cash to our shareholders. Looking at the numbers, our team posted total sales of $8.2 billion in the quarter.We delivered organic growth of 1% which is on top of 7% growth in last year's third quarter. As you recall from the discussion on our July earnings call, our ERP rollout in the US resulted in revenue shifting between Q2 and the second half of the year. Today, we estimate a pull forward into Q2 was approximately 100 basis points with the vast majority coming out of Q3.Moving on to earnings per share, we posted EPS of $2.58, an increase of 11% year-over-year. Our company continues to deliver strong return on invested capital along with premium margins.Companywide we generated margins of 25% with all business groups above 22%. Our team also increased free cash flow by 24% year-over-year with a conversion rate of 114%. This is a testament to the strength of portfolio and business model, and our focus on driving productivity every day. We also continue to invest in R&D and capital to support organic growth while returning cash to our shareholders. And in the quarter, we returned $1.9 billion to 3M shareholders through both dividends and share repurchases.Please turn to Slide 5 for look at the performance of our business groups for both the third quarter and year-to-date. In the third quarter, three of our five business groups, Electronics and Energy, Industrial and Safety and Graphics posted organic growth of 2%. Healthcare and Consumer each had areas of strength, but also areas that were softer than expected. Healthcare's growth declined by 1% primarily due to continued weakness in our drug delivery business. Organic growth in Consumer was down 2%. This business group was impacted by channel adjustments between quarters with our major retail customers, though the sellout of our products remains strong. In his comments, Nick will provide more detail on third quarter performance of each business group.Given the shift of sales between quarters due to business transformation, it is also helpful to look at our performance through nine months. Safety and Graphics posted 6% growth followed by 3% growth from both Industrial and Electronics and Energy. Healthcare posted 2% growth with Consumer at 1%. Companywide, we have delivered organic growth of more than 3% year-to-date. I will come back to share our updated guidance after Nick takes us through the details of the quarter. Nick?",

'ABT': "With the exception of any participant's questions asked during the question-and-answer session, the entire call, including the question-and-answer session, is material copyrighted by Abbott. It cannot be recorded or rebroadcast without Abbott's expressed written permission.And I would now like to introduce Mr. Scott Leinenweber, Vice President, Investor Relations, Licensing and Acquisitions. Scott LeinenweberGood morning and thank you for joining us. With me today are Miles White, Chairman of the Board and Chief Executive Officer; and Brian Yoor, Executive Vice President, Finance and Chief Financial Officer. Miles will provide opening remarks and Brian will discuss our performance and outlook in more detail. Following their comments, Miles, Brian and I will take your questions.Before we get started, some statements made today may be forward-looking for purposes of the Private Securities Litigation Reform Act of 1995, including the expected financial results for 2018. Abbott cautions that these forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those indicated in the forward-looking statements. Economic, competitive, governmental, technological and other factors that may affect Abbott's operations are discussed in Item 1a, Risk Factors to our Annual Report on Securities and Exchange Commission Form 10-K for the year ended December 31, 2017.Abbott undertakes no obligation to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law. Please note that third quarter financial results and guidance provided on the call today for sales, EPS and line items of the P&L will be for continuing operations only.On today's conference call, as in the past, non-GAAP financial measures will be used to help investors understand Abbott's ongoing business performance. These non-GAAP financial measures are reconciled with the comparable GAAP financial measures in our earnings news release and regulatory filings from today, which are available on our website at abbott.com.Unless otherwise noted, our commentary on sales growth refers to organic sales growth, which adjusts the 2017 basis of comparison to exclude the impact of exchange and historical results for Abbott's medical optics and St. Jude's vascular closure businesses, which were divested during the first quarter of 2017, as well as current and prior year sales for Alere which was acquired on October 3, 2017.With that, I will now turn the call over to Miles.Miles WhiteOkay. Thanks, Scott, and good morning. Today, we reported results of another strong quarter with ongoing earnings per share of $0.75 along with sales growth of approximately 8% on an organic basis, reflecting well balanced growth across all four of our businesses. I'm particularly pleased with the continued productivity of our new product pipeline and would like to highlight a couple areas where our products are creating and fundamentally shaping markets. I'll start with Structural Heart, where we're the world or the global leader in minimally invasive treatments for mitral regurgitation or a leaky heart valve. We've recently made several significant advancements in this area. In July, in U.S., we initiated a pivotal trial for Tendyne, our device that is designed to replace damaged mitral heart valves without the need for open heart surgery. We also received U.S. FDA approval for our third generation version of MitraClip, our market leading device for the repair of mitral heart valve. And in September, we announced results of our landmark COAPT trial, which demonstrated that MitraClip improves survival and clinical outcomes for patients with functional mitral regurgitation, the most prevalent form of this condition. We expect to submit this study data to the U.S. FDA in the coming weeks to support consideration of an expanded indication for MitraClip. These advancements will further enhance and strengthen our leadership position in this large and highly underpenetrated disease area and will bring new therapies to patients for effective treatment options that are currently limited. Diabetes Care is another area where our technologies are making a big impact, specifically FreeStyle Libre, a revolutionary glucose monitoring system that eliminates the need for routine fingersticks. In the U.S., we received FDA approval for a 14-day sensor with a shorter one-hour warmup making Libre the longest lasting wearable glucose sensor available. And in Europe, we obtained CE Mark for our FreeStyle Libre 2 system, our newest generation 14-day system, with optional real-time alarms. In a relatively short period of time, FreeStyle Libre now has more than 1 million users across the globe, a testament to the mass market appeal of this product, which is fundamentally changing the way people with diabetes manage their disease. I'll now summarize our third quarter results in more detail before turning call over to Brian. I'll start with Diagnostics, where sales grew 7.5% in the quarter. Alinity, our family of highly differentiated instruments is achieving accelerated growth and strong competitive win rates in Europe where more than 50% of our Alinity instrument placements thus far are coming from share capture. The global rollout of Alinity positions this business for a consistent above market growth for years to come as we capture share and bring the full suite of systems to additional geographies including the U.S. ",

'ABBV': "I would now like to introduce Ms. Liz Shea, Vice President of Investor Relations.Elizabeth Shea - AbbVie, Inc.Good morning and thanks for joining us. Also on the call with me today are: Rick Gonzalez, Chairman of the Board and Chief Executive Officer; Michael Severino, Executive Vice President of Research and Development and Chief Scientific Officer; Bill Chase, Executive Vice President of Finance and Administration; and Rob Michael, Senior Vice President and Chief Financial Officer.Before we get started, I would like to remind you that statements we make today are or may be considered forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995. AbbVie cautions that these forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those indicated in the forward-looking statements. Additional information about the factors that may affect AbbVie's operations is included in our 2017 Annual Report on Form 10-K and in our other SEC filings. AbbVie undertakes no obligation to release publicly any revisions to forward-looking statements as a result of subsequent events or developments except as required by law.On today's conference call, as in the past, non-GAAP financial measures will be used to help investors understand AbbVie's ongoing business performance. These non-GAAP financial measures are reconciled with comparable GAAP financial measures in our earnings release and regulatory filings from today which can be found on our website. Following our prepared remarks we'll take your questions.So with that I'll now turn the call over to Rick.Richard A. Gonzalez - AbbVie, Inc.Thank you, Liz. Good morning, everyone, and thank you for joining us today. I'll discuss our third quarter performance, our full-year 2018 guidance, and I'll provide some comments about our expectations for 2019. Mike will then provide an update on recent advancements across our R&D pipeline and Bill will discuss the quarter in more detail. Following our remarks, as usual, we will take your questions.We delivered another quarter of outstanding performance with results once again ahead of our expectations. We've driven strong commercial, operational, and R&D execution resulting in industry-leading top and bottom line growth. Adjusted earnings per share were $2.14, representing growth of more than 50% versus last year. Total adjusted operational sales growth of 18.5% was driven by a number of products in our portfolio including HUMIRA with global operational sales growth of nearly 10% and IMBRUVICA which grew more than 40% versus the prior year. HCV was a substantial contributor in the quarter with more than $860 million in sales, and we also saw strong performance from several other products including VENCLEXTA, CREON, DUODOPA and LUPON. Based on the continued strength of our business in the quarter and our progress year to date, we are raising our 2018 earnings guidance for the fourth time this year. We now expect full-year 2018 adjusted earnings per share of $7.90 to $7.92, reflecting growth of more than 41% at the midpoint. This represents exceptional earnings growth and puts us at the very top of our industry peer group.And while 2018 certainly sets a very high bar for performance, we expect strong earnings growth once again next year. Although it's too early to provide specific growth targets for 2019 as we're still in the midst of our annual planning process, based on our strong underlying business momentum, we are confident in our ability to deliver double digit earnings growth once again in 2019. And importantly, we expect to deliver this level of growth despite a number of factors including direct biosimilar competition, impacting our more than $6 billion international HUMIRA business; a difficult comparison year, particularly in light of the rapid ramp of our HCV business in 2018; and the significant investment we will be making in 2019 to support new product launches including VENCLEXTA, ORILISSA, risankizumab and upadacitinib. Clearly 2019 will be an important year for AbbVie, an opportunity for us to clearly demonstrate our ability to continue to drive strong earnings growth.In addition to the strong bottom line performance, we also expect to continue to generate significant cash flows. Underscoring the continued confidence in our business, today we're announcing 11.5% increase in our quarterly cash dividend from $0.96 per share to $1.07 per share beginning with the dividend payable in February 2019. Since our inception, we have grown our quarterly dividend nearly 170%.Also in the quarter, we announced two additional patent license agreements over proposed HUMIRA biosimilar products. These agreements, of which there are now five in total, are yet another example of the strength of our intellectual property, and we remain confident that we will not see direct biosimilar competition in the U.S. until 2023.As we look at our business and evaluate our prospects, just about every aspect of our business is performing at or above our expectations. Our pipeline remains one of the best in the industry and the progress we're making to bring new products to the market will allow us to support our long-term growth expectations. Let me highlight a few examples. We have invested significantly in oncology over the past several years to build a major new growth driver for AbbVie. Today our hematological oncology portfolio is now annualizing above $4 billion and growing at a robust rate, including growth of more than 48% in the third quarter.",

'ABMD': "I would now like to introduce your host for today's conference, Ingrid Goldberg, Director of Investor Relations. Please go ahead.Ingrid GoldbergThank you. Good morning and welcome to Abiomed's third quarter fiscal 2018 earnings conference call. This is Ingrid Goldberg, Director of Investor Relations for Abiomed, and I'm here with Mike Minogue, Abiomed's Chairman, President and Chief Executive Officer, and Bob Bowen, Former Chief Financial Officer and Consultant to Abiomed.The format for today's call will be as follows: First, Mike Minogue will discuss strategic highlights from the third fiscal quarter and then turn to key operational and strategic objectives. Next, Bob Bowen will provide details on the financial results outlined in today's press release. We will then open the call for your questions.Before we begin, I would like to remind you that comments made on today's call may contained forward-looking statements about the Company's progress relating to financial performance, clinical, regulatory, commercial, litigation and other matters. These forward-looking statements are subject to certain risks and uncertainties that may cause actual results to differ materially from those expressed or implied in the forward-looking statements.Additional information regarding these risks and uncertainties are described in the earnings release we issued this morning, our Annual Report on Form 10-K for the year ended March 31, 2017, and our most recently filed Quarterly Report on Form 10-Q. We undertake no obligation to update or revise any of these forward-looking statements as a result of subsequent events or developments, except as required by law.During today's call adjusted net income and adjusted net income per diluted share and non-GAAP measures will be used to help investors understand the Company's financial performance. These financial measures are reconciled with the comparable GAAP financial measures in the earnings release and regulatory filing from today which are available in the Investor Section of our website at www. abiomed.com.Thank you for joining us. I'm now pleased to introduce, Abiomed's Chairman, President and Chief Executive Officer, Mike Minogue.Michael MinogueThanks, Ingrid. Good morning, everyone. In Q3, Abiomed delivered best ever quarterly results on nearly every metric starting with $154 million in revenue, up 34%. Our robust growth set new records and was driven by U.S. patient utilization for both protected PCI and emergent support, which increased 24% and 43% respectively. In Company history, our top three U.S. Impella utilization months were all in Q3.We also achieved records in Europe aided by strength in Germany which grew 71% year-over-year. Our operational discipline and execution allowed us to achieve best-in-class gross margin of 84% and our best ever operating margin of 29%. We generated an additional $57 million in cash from operations, which brings our cash position to $351 million. We now own both manufacturing and training facilities in Massachusetts and Aachen, Germany and maintain no debt as a company.With our solid balance sheet, we are investing in innovation, education, and our patent portfolio. This quarter, we marked a new milestone of 300 patents awarded and an additional 272 patents pending. It is an exciting time as we collaborate with our customers to improve patient outcomes and the standard of care for circulatory support. As a result, the field of heart recovery is growing, and Abiomed is well positioned to capture the $5 billion U.S. market opportunity while planting the seeds for future growth in global markets.For today's call, I will highlight the clinical need and growing awareness of heart recovery with Impella support in the U.S., Germany, and Japan. Starting with the U.S., both the protected PCI and cardiogenic shock indications established new quarterly records. Our Impella adoption increased to a total of 9% of the 121,000 high-risk PCI and 100,000 emergency patients. We continue to have a long runway for growth because of our clinical benefits and FDA approvals.Our focus on training data and time combined with independent physician-led initiatives like CHIP and the National CSI continues to improve awareness and is having an impact on adoption. Last quarter, I spoke about a publication from the Advisory Board, an independent expert healthcare consultant company acquired by United Healthcare. This quarter, the Advisory Board circulated two additional publications referencing Impella.The first publications comes from the Cardiovascular Roundtable Annual Meeting, protected PCI, complex coronary artery disease and cardiogenic shock were highlighted as advanced programs that enable innovative hospitals to differentiate themselves and capture new market opportunities. As a reference TAVR and mitral valve are also on this list.The second publication stressed the significant clinical need for the growing cardiogenic shock population. The report outlined the necessity for aligned patient care recommended tactics for building a cardiogenic shock network and addressed the benefits ranging from improved quality of care to alleviated cost burden. This timely publication piggybacks on the success of this year's TCT physician call to ARMS around improving outcomes in cardiogenic shock and this initiative is underway across United States.",

'ACN': 'I would now like to turn the conference over to our host and facilitator as well as our Managing Director, Head of Investor Relations, Angie Park. Please go ahead.Angie ParkThank you, Steve, and thanks, everyone, for joining us today on our third quarter fiscal 2018 earnings announcement. As the operator just mentioned, I’m Angie Park, Managing Director, Head of Investor Relations.With me today are Pierre Nanterme, our Chairman and Chief Executive Officer; and David Rowland, our Chief Financial Officer. We hope you’ve had an opportunity to review the news release we issued a short time ago.Let me quickly outline the agenda for today’s call. Pierre will begin with an overview of our results. David will take you through the financial details, including the income statement and balance sheet for the third quarter. Pierre will then provide a brief update on our market positioning before David provides our business outlook for the fourth quarter and full fiscal year 2018. We will then take your questions before Pierre provides a wrap up at the end of the call.As a reminder, when we discuss revenues during today’s call, we’re talking about revenues before reimbursements or net revenues. Some of the matters we’ll discuss on this call, including our business outlook are forward-looking and as such, are subject to known and unknown risks and uncertainties, including but not limited to those factors set forth in today’s news release and discussed in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and other SEC filings. These risks and uncertainties could cause actual results to differ materially from those expressed on this call.During our call today, we will reference certain non-GAAP financial measures which we believe provide useful information for investors. We include reconciliations of non-GAAP financial measures where appropriate to GAAP in our news release or in the Investor Relations section of our website at accenture.com. As always, Accenture assumes no obligation to update the information presented on this conference call.Now, let me turn the call over to Pierre.Pierre NantermeThank you, Angie, and thanks, everyone, for joining us today. Accenture had a truly outstanding third quarter. We delivered excellent results from new bookings and revenues to operating margin, EPS and cash flow, and we gained significant market share once again.The durability of our performance demonstrates the relevance of our growth strategy and our ability to continue delivering strong results and returns for our shareholders, while at the same time investing significantly in new growth opportunities to strengthen our position for the long-term.Here are a few highlights from the quarter. We delivered record new bookings of $11.7 billion. We grew revenues 11% in local currency to $10.3 billion, and our growth continues to be well-balanced across the dimensions of our business. We delivered earnings per share of $1.79 on an adjusted basis, an 18% increase.Operating margin was 15.7%, an expansion of 20 basis points on an adjusted basis. We generated very strong free cash flow of $1.8 billion, and we returned approximately $1.6 billion in cash to shareholders through share repurchases and the payment of our semiannual dividend.So we’re entering the fourth quarter with excellent momentum in our business, and I feel confident that we are very well-positioned to deliver our business outlook for the year.Now, let me hand over to David, who’ll review the numbers in greater detail. David, over to you?David RowlandThank you, Pierre, and thanks to all of you for taking the time to join us on today’s call. As you heard in Pierre’s comments, we’re extremely pleased with our results in the third quarter, which once again, reflect strong momentum across every dimension of our business.Based on the strength of our third quarter results and the strong confidence and visibility we have in our fourth quarter, we will be increasing key elements of our full-year outlook, which I’ll cover in more detail later in our call. Importantly, both our third quarter results and our updated outlook for the full-year reflect very strong execution against all three financial imperatives for driving superior shareholder value, which I covered in some detail at our Investor Analyst Day in April.So before I get into the details of the quarter, let me summarize the major headlines of our third quarter results. Net revenue increased more than $1.4 billion, reflecting growth of a 11% local currency and representing the third consecutive quarter of double-digit growth.The strong top line growth exceeded our expectations and reflected strong and balanced growth across all operating groups and geographic areas with several growing double digits. The growth continues to significantly outpace the market, reflecting both our leadership position in "the New" and the durability of our diverse yet highly focused growth model.',

'ATVI': "Good day, everyone, and welcome to the Activision Blizzard Q3 2018 earnings conference call. Today's conference is being recorded.At this time, I would like to turn the conference over to Christopher Hickey, Senior Vice President of Investor Relations. Please go ahead, sir.Christopher Hickey - Activision Blizzard, Inc.I would like to remind everyone that during this call, we will be making statements that are not historical facts. The forward-looking statements in this presentation are based on information available to the company as of the date of this presentation. And while we believe them to be true, they ultimately may prove to be incorrect.A number of factors could cause the company's actual future results and other future circumstances to differ materially from those expressed in any forward-looking statements. These include the risk factors discussed in our SEC filings, including our 2017 Annual Report on Form 10-K, and those on the slides that are showing. The company undertakes no obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after today, November 8, 2018.We will present both GAAP and non-GAAP financial measures during this call. Non-GAAP financial measures exclude the impact of expenses related to stock-based compensation, the amortization of intangible assets and expenses related to acquisitions, including legal fees, costs, expenses, and accruals, expenses related to debt financings and refinancings, restructuring charges, the associated tax benefits of these excluded items, and the impact of certain significant discrete tax-related items.These non-GAAP measures are not intended to be considered in isolation from, as a substitute for, or superior to our GAAP results. We encourage investors to consider all measures before making an investment decision. Please refer to our earnings release, which is posted on www.activisionblizzard.com, for a full GAAP to non-GAAP reconciliation and further explanation with respect to our non-GAAP measures.There's also a PowerPoint overview, which you can access with the webcast and which will be posted to the website following the call. In addition, we will be posting a financial overview highlighting both GAAP and non-GAAP results and a one-page summary.And now I'd like to introduce our CEO, Bobby Kotick.Robert A. Kotick - Activision Blizzard, Inc.Thank you all for joining us today.Our results for the third quarter exceeded our prior outlook, as we continue to entertain large audiences, drive deep engagement, and attract significant audience investment across our franchises. Last quarter, on average, 345 million people played our games each month, and our players spent a record 52 minutes per day playing Activision, Blizzard, and King games.Our unique advantage is the ability to create the most compelling interactive and spectator entertainment based on our own franchises combined with our direct digital connection to hundreds of millions of customers in over 190 countries. With these competitive advantages, we continue to connect and engage the world through epic entertainment.Very few companies are able to consistently deliver compelling content to hundreds of millions of customers. Fewer still can provide their audiences with flexible methods of payment for that content. For our hundreds of millions of customers, we now offer content on phones, computers, and video game consoles, and subscription billing, direct digital download billing, virtual item sales, digital advertising, and of course, we still sell our products through tens of thousands of stores around the world.As an example of the breadth of our capabilities, we launched Call of Duty: Black Ops 4 on October 12. Ordinarily, we launch new Call of Duty titles this week in November. But we believe holiday customers, of which there are millions, will benefit from more players in the game earlier.Our engagement to date is better than any Call of Duty content in recent years, and spectator viewing is higher than ever before. As a franchise, Call of Duty has now generated more revenue than the Marvel Cinematic Universe in the box office, and double that of the cumulative box office of Star Wars. We have an exciting future planned for Call of Duty players, including our new Call of Duty professional player opportunities, and lots of exciting new content in 2019 and beyond.We remain focused on the key growth drivers of our business that we believe present meaningful revenue and engagement upside, including live operations, mobile, and investment in new and growing franchise engagement models. We're pleased with our early momentum in areas like our advertising initiatives, which continue to exceed our plans, as revenues grew almost 50% sequentially.",

'ADBE': "Mike SaviageGood afternoon, and thank you for joining us today. Joining me on the call are Adobe's President and CEO, Shantanu Narayen; and John Murphy, Executive Vice President and CFO.In our call today, we will discuss Adobe's third quarter fiscal year 2018 financial results. By now, you should have a copy of our earnings press release which crossed the wire approximately one hour ago. We've also posted PDFs of our earnings call prepared remarks and slides, financial targets and an updated investor datasheet on Adobe.com. If you would like a copy of these documents, you can go to Adobe's Investor Relations page and find them listed under Quick Links.Before we get started, we want to emphasize that some of the information discussed in this call, particularly our revenue and operating model targets and our forward-looking product plans, is based on information as of today, September 13, 2018, and contains forward-looking statements that involve risk and uncertainty. Actual results may differ materially from those set forth in such statements. For a discussion of these risks and uncertainties, you should review the Forward-Looking Statements Disclosure in the earnings press release we issued today as well as Adobe's SEC filings.During this call, we will discuss GAAP and non-GAAP financial measures. A reconciliation between the two is available in our earnings release and in our updated investor datasheet on Adobe's Investor Relations website.Call participants are advised that the audio of this conference call is being webcast live in Adobe Connect and is also being recorded for playback purposes. An archive of the webcast will be made available on Adobe's Investor Relations website for approximately 45 days and is the property of Adobe. The call audio and the webcast archive may not be re-recorded or otherwise reproduced or distributed without prior written permission from Adobe.I will now turn the call over to Shantanu.Shantanu NarayenThanks, Mike, and good afternoon. Q3 was a record quarter for Adobe. We delivered $2.29 billion in revenue, representing 24% year-over-year growth. GAAP earnings per share for the quarter was $1.34, and non-GAAP earnings per share was $1.73.Adobe is empowering people to create and transforming how businesses compete. Our execution against this strategy is driving strong financial results across our Digital Media and Digital Experience businesses. In every market around the world, students, creatives, enterprises and governments are choosing Adobe Creative Cloud, Document Cloud and Experience Cloud to deliver the transformative digital experiences required to compete and win today. In our Digital Media business, we achieved strong growth in both Creative Cloud and Document Cloud revenue in Q3. Net new Digital Media annualized recurring revenue or ARR was $339 million, and total Digital Media ARR exiting Q3 grew to $6.4 billion. Key Digital Media customer engagements in the quarter included the U.S. Department of Education, Facebook, Marks & Spencer and Walmart.Creative Cloud has become the creativity platform for all with millions of highly engaged subscribers and a strong base of trialists whom we actively convert each month into paying customers. Whether it's YouTubers looking for an intuitive video solution or mobile-first photography enthusiasts, we continue to see significant opportunities for growth in new customer segments as well as untapped potential in emerging markets. Video continues to be an explosive category. In June, we previewed Project Rush, a new video editing app that makes creating and sharing online video content easier than ever. Whether your passion is vlogging about food or posting a cool skateboarding clip, Project Rush gives users a way to create video projects across surfaces, providing them with maximum creative flexibility.This week at IBC, we shared a slate of new video creation capabilities that'll speed up video production and enable more seamless workflows for professional editors and animators. This includes Adobe Sensei-powered features for audio editing, color grading and animation in Premiere Pro, Audition, Character Animator and other video tools.Lightroom CC, our cloud-based photography service, continues to attract new customers. We announced a number of updates to Lightroom CC and Lightroom Classic for Mac, Windows, Android and iOS and shipped several improvements including new in-app learning capabilities, support for new cameras and more than 1,200 different lenses. We previewed a brand-new feature, Best Photos, which combines Adobe Sensei intelligence with user-made edits to quickly recommend the best photos within an album.Adobe XD, our all-in-one UX solution for designing and prototyping websites and apps, is quickly becoming the leader in the screen design category with strong monthly active usage among customers. This quarter, we unveiled new open platform capabilities, which allow users to customize their workflow with a broader ecosystem of community and partner plug-ins. As students around the world head back to school, Adobe is partnering with educators and institutions to ensure that creativity, a core 21st century skill, is a central part of curriculum and that students have access to the creative tools they need. Adobe Spark, our app for easily creating high-quality graphics, web pages and video stories, is a cornerstone of this effort. This quarter, we were proud to partner with the Ministry of Skill Development in India to enable more than 1 million students to access Spark.",

'AMD': "Laura Graves - Advanced Micro Devices, Inc.Thank you. And yes, welcome to AMD's third quarter 2018 conference call. By now, you should have had an opportunity to review a copy of our earnings release and slides. If you have not reviewed these documents, they can be found on the Investor Relations page of AMD's website, www.amd.com.Participants on today's conference call are Dr. Lisa Su, our President and Chief Executive Officer; and Devinder Kumar, our Senior Vice President, Chief Financial Officer, and Treasurer. This is a live call, and will be replayed via webcast on our website.I would like to highlight some important dates for you. AMD's next Horizon event is scheduled for Tuesday, November 6, 2018, where we will discuss innovation of AMD products and technologies, specifically designed for the datacenter on industry-leading 7-nanometer process technology. Dr. Lisa Su, President and Chief Executive Officer, will present at the Credit Suisse 22nd Annual Technology Media & Telecom Conference on Tuesday, November 27. And our 2018 fourth quarter quiet time will begin at the close of business on Friday, December 14.Today's discussion contains forward-looking statements based on the environment as we currently see it. Those statements are based on current beliefs, assumptions, and expectations; speak only as of the current date; and as such, involve risks and uncertainties that could cause actual results to differ materially from our expectations.We will refer primarily to non-GAAP financial measures during this call except for revenue, gross margin, and segment operational results, which are on a GAAP basis. The non-GAAP financial measures referenced today are reconciled to their most directly comparable GAAP financial measure in today's press release posted on our website. Please refer to the cautionary statements in our press release for more information. You will also find detailed discussions about our risk factors in our filings with the SEC and, in particular, AMD's Quarterly Report on Form 10-Q for the quarter ended June 30, 2018.Now, with that, I will hand the call over to Lisa. Lisa?Lisa T. Su - Advanced Micro Devices, Inc.Thank you, Laura, and good afternoon to all those listening in today. We executed well in the third quarter. We continued to build momentum for our new products as strong sales of our Ryzen and EPYC processors offset soft GPU channel sales, and drove our fifth consecutive quarter of year-on-year revenue growth, increased profitability and margin expansion.Third quarter revenue was $1.65 billion, an increase of 4% from a year ago. Looking at our Computing and Graphics segment, third quarter CG segment revenue increased 12% year-on-year, driven by significant growth in both client processor and OEM GPU sales that offset a larger-than-expected decline in channel GPU sales.Ryzen processor sales increased to more than 70% of our total client revenue in the quarter. We delivered our highest processor unit shipment in nearly four years, and believe we gained desktop and notebook client processor unit share in the quarter, driven by growth with both OEMs and in the channel. In desktop, we had strong demand for our higher end Ryzen 7, Ryzen 5 and Ryzen Threadripper processors, helping to drive a double-digit percentage year-over-year and sequential improvement in client processor ASP.We expanded our desktop offerings in the quarter, bringing our Zen processor core and Vega Graphics to the entry level part of the market with the Athlon APU, and launching our flagship 32-core Threadripper 2 processor. With these new introductions, we now have a top to bottom lineup of client processors, based on our high-performance Zen architecture.In notebooks, Ryzen mobile processor unit shipments doubled sequentially for the second straight quarter as OEMs ramped production of their latest AMD-based notebooks. 54 of the 60 Ryzen processor based notebooks planned for 2008 (sic) [2018] (04:45) have launched with the final notebooks expected to go on sale this quarter. Based on the success of first-generation Ryzen mobile notebooks, the expanded breadth of our customer engagements and our design win momentum, we are on track for an even larger assortment of AMD-powered notebooks in 2019.In graphics, the year-over-year revenue decrease was primarily driven by significantly lower channel GPU sales, partially offset by improved OEM and datacenter GPU sales. Channel GPU sales came in lower than expected, based on excess channel inventory levels, caused by the decline in blockchain-related demand that was so strong earlier in the year. OEM GPU sales in the third quarter increased by a strong double-digit percentage year-over-year as new design wins began to ramp, including first shipments of our mobile Vega GPUs to support new premium notebooks launching this quarter.",

'AAP': 'Elisabeth EislebenGood morning, and thank you for joining us to discuss our third quarter 2018 results. I’m joined by Tom Greco, our President and Chief Executive Officer; Jeff Shepherd, our Executive Vice President, Chief Financial Officer, Controller and Chief Accounting Officer; Bob Cushing, our Executive Vice President of Professional; and Mike Broderick, our Executive Vice President, Merchandising and Store Operations Support. Following their prepared remarks, we will turn our attention to answering your questions.Before we begin, please be advised that our comments today may include forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. While actual results may differ materially from those projected in such statements due to a number of risks and uncertainties, which are described in a Risk Factors section in the company’s filings with the Securities and Exchange Commission, we maintain no duty to update forward-looking statements made.Additionally, our comments today include certain non-GAAP financial measures. We believe providing these measures helps investors gain a more complete understanding of our results and is consistent with how management views our financial results. Please refer to our quarterly press release and accompanying financial statements issued today for additional detail regarding the forward-looking statements and reconciliations of these non-GAAP financial measures to the most comparable GAAP measures referenced in today’s call. The content of this call will be governed by the information contained in our earnings release and related financial statements.Now, let me turn the call over to Tom Greco.Tom GrecoThanks, Elizabeth, and good morning. First, I’d like to thank the entire Advance team and our network of Carquest Independent for a strong quarter, characterized by progress on virtually every financial and marketplace metric. It’s because of their dedication and unrelenting focus on the customer that we were able to deliver our strongest comparable sales growth in nearly eight years, which in turn led to improved market share performance. It’s clear that our transformation actions are beginning to take hold, driving meaningful improvements in execution, enabling us to earn more business with our valued customers.In the third quarter, net sales increased by 4.3% to $2.3 billion and comp sales were up 4.6%. Our adjusted operating income margin of 8.5% increased 62 basis points compared to the prior year quarter. And our adjusted earnings per share increased 32.2% to $1.89.Year-to-date, our free cash flow was $576 million, an increase of $336 million year-over-year, as we continue to drive disciplined cash management practices throughout the organization. Our sales performance in the quarter is a testament to the hard work of our entire team, truly living our cultural belief and executing on our mission, Passion for Customers, Passion for Yes!Not only did we deliver the strongest comparable sales growth since 2010, our absolute growth in the quarter was above the industry average, driven by increased units per transaction and average ticket value. Importantly, we strengthened our customer value proposition and delivered balanced, consistent growth throughout Q3 in both our DIY omni-channel and professional businesses.From a geographic perspective, we saw improvement across all 12 regions. Our Southeast, Midwest, Appalachia, Northeast, and Mid-Atlantic regions led the way. From a category perspective, we saw increased sales across nearly every category with the strongest growth in brakes, batteries, and optics, where we delivered high single-digit growth. Without a doubt, we’re seeing better coordination and planning across our merchandising, marketing and field operations teams, which is also contributing to our momentum.Finally, we’re leveraging supplier partnerships and improved analytical capabilities to ensure we have the right inventory, in the right locations, at the right time. This is a work-in-progress and we still have significant opportunity, but we believe that the improvements made so far are helping our improved execution.Going a little deeper in Professional, we saw improved performance across every AAP banner in the U.S., including Advance, Worldpac, Autopart International and importantly both Carquest Corporate and Independent stores. Our customers want choices, and thanks to cross-banner visibility, we’re doing a much better job of leveraging AAP’s industry leading assortment of brands to ensure our pro customers have the options they desire to meet the needs of their customers.Through continued focus on our customer value proposition and direct feedback from our professional customers, we recently launched myadvance.com. This is an interactive, easy to use, mobile friendly platform where we’ve combined multiple online tools and capabilities into one place, including our Advance Pro online ordering platform.On myadvance.com, professional customers can access industry-leading cross-banner assortment as well as best-in-class shop services and solutions such as an expert corner featuring content rich training and shop business solution advice from automotive aftermarket industry leaders. These initiatives are driving incremental growth for our Professional business.We’re equally excited about the growth within our DIY omni-channel business. In Q3, we saw increases in both DIY retail and DIY online, marking the second consecutive quarter with sales growth in both. We launched our new advertising campaign, Think Ahead. Think Advance, and it’s off to a great start. We continue to invest in e-commerce, where enhancements we made to our website improved the customer experience, including reduced page load times and additional personalization modules.In addition, well today, the majority of our online orders are, buy online pickup in store, we’ve made progress on our ship to home capabilities. Overall, our investments drove strong double-digit revenue growth in Q3. While we are pleased that our improving execution is driving topline strength, we remain focused on controlling expenses across the organization. I was delighted with our store team’s ability to once again, leverage additional customer service hours through increased sales in the third quarter.In addition, we’re seeing a noticeable shift in culture as safety has become a critical focus throughout Advance. Importantly, our progress on safety initiatives enabled a reduction in liability and vehicle claims in the quarter and we expect to see further benefits as a result of our safety initiatives. Our investment in this critical area has paid off quickly and I’m confident we’re developing a true safety culture with heightened attention on team member safety throughout Advance.',

'AES': "I would now like to turn the conference over to Ahmed Pasha, Vice President, Investor Relations. Please go ahead.Ahmed PashaThank you, Brendon. Good morning and welcome to our third quarter 2018 financial review call. Our press release, presentation and related financial information are available on our website at aes.com.Today, we will be making forward-looking statements during the call. There are many factors that may cause future results to differ materially from these statements. Please refer to our SEC filings for a discussion of these factors.Joining me this morning are Andrés Gluski, our President and Chief Executive Officer; Tom O'Flynn, our Chief Financial Officer; Gustavo Pimenta, Deputy Chief Financial Officer; and other senior members of our management team.With that, I will turn the call over to Andrés. Andrés.Andrés GluskiGood morning everyone and thank you for joining our third quarter 2018 financial review call. We had a strong quarter demonstrated by solid financial results and excellent progress towards achieving our strategic goals. We continue to improve the returns from our existing portfolio and position AES for long-term sustainable growth.Our third quarter adjusted EPS of $0.35 puts us at $0.88 for the first nine months of 2018 which is 35% higher than the $0.65 we earned in the same period last year. We remain on-track to achieve our 2018 guidance and longer term expectations. Tom will discuss our results in more detail after I provide a review of our strategic accomplishments. I will structure my remarks today around four overall themes; first, optimizing our returns; second, our growing backlog of renewable projects; third, advancing our LNG strategy; and finally, deploying new technologies. I have discussed these themes in the past, and on this call I will provide concrete examples of how we're delivering on each in support of our overall strategy.Beginning on Slide 4 with optimizing our returns. We have been reshaping our portfolio to deliver attractive returns to our shareholders while reducing our overall risk and carbon footprint. As can be seen on the slide, our renewable investments are projected to produce low-to-high teen IRRs across all markets assuming conservative terminal values. Specifically, as you may recall, we bought sPower in 2017 at a high single-digit return; since then we have taken steps to enhance that return including refinancings and operational improvements. This morning we announced that we have agreed to sell 24% of sPower's operating portfolio to Ullico. As a result of all of these actions we have improved our expected return on sPower's operating portfolio to around 13%, and we will use the proceeds to help fund new solar and wind projects in the U.S.Now turning to our backlog of renewable projects beginning on Slide 5. Our robust pipeline continues to increase driven by our focus on select markets where we can take advantage of our global scale and synergies with our existing businesses. So far this year we have signed 1.9 gigawatts of long-term PPAs for renewable projects or 93% of our internal projection of 2 gigawatts for full year 2018. We are on pace to sign 2 to 3 gigawatts of new PPAs annually for 2019 and 2020. We expect this capacity to be split 50-50 between the U.S. and internationally, and similarly, between solar and wind. By the end of 2020 we expect to have signed 7.5 gigawatts of new renewable PPAs all of which will be online by 2022. To complement our strategy to invest in attractive renewable projects and expand our environmental, social and governance related disclosures; next week we will be releasing a climate scenario report that complies with the guidelines of the task force on climate related financial disclosures and includes updated carbon intensity reduction targets that reflect our renewable growth.Now onto Slide 6 and how we are capitalizing on our existing footprint. As you may recall, on our last call we introduced our green blend and extend strategy. With this win-win strategy we leverage our existing platforms, contracts and relationships to negotiate new long-term PPAs with higher returns than we would otherwise get through a bidding process. We see potential opportunities to execute on this strategy across many of our markets including Chile, Mexico and United States. In the near-term we see an addressable universe of 7 gigawatts across our portfolio which could substantially increase as other markets capitalize on the economic benefits of renewables.Turning to Slide 7; we have signed two green blend and extend contracts for a total of 576 megawatts in Chile and Mexico. The contract in Chile was the first of it's kind; we signed an 18-year contract with an existing customer for 1,100 gigawatt hours of annual delivery [ph] which is equivalent to 270 megawatts of renewable capacity. This will lengthen AES Gener's average contract life to 11 years, replace 5% of AES Gener's total load, and 40% of the thermal PPAs expiring in 2022. We are also implementing a similar contract in Mexico with our off-taker Penoles. To help Penoles gradually replace pet-coke with greener, efficient renewable energy, we negotiated a 25-year PPA to build the 306 megawatt Mesa La Paz wind project leveraging our strong existing customer relationship and our global renewables capabilities. This will increase our average contract life with Penoles from 8 years to 17 years.",

'AMG': "I would now like to turn the conference over to your host, Mr. Jeff Parker, Vice President, Investor Relations for AMG. Thank you. You may begin.Jeffrey ParkerThank you for joining AMG to discuss our results for the third quarter of 2018.In this conference call, certain matters discussed will constitute forward-looking statements. Actual results could differ materially from those projected due to a number of factors, including, but not limited to, those referenced in the Company's Form 10-K and other filings we make with the SEC from time to time. We assume no obligation to update any forward-looking statements made during the call.AMG will provide on the Investor Relations section of its website, at www.amg.com, a replay of the call, a copy of our announcement of our results for the quarter, a reconciliation of any non-GAAP financial measures to the most directly comparable GAAP financial measures, including a reconciliation of any estimates of the Company's economic earnings per share for future periods that are announced on this call and an investor presentation. AMG encourages investors to consult the Investor Relations section of its website regularly for updated information.With us on the line to discuss the Company's results for the quarter are Nate Dalton, President and Chief Executive Officer; and Jay Horgen, Chief Financial Officer.With that, I'll turn the call over to Nate.Nate DaltonThanks, Jeff, and good morning everyone. Against the challenging industry backdrop, AMG generated solid results in the third quarter of 2018, including positive net client cash flows of approximately $1 billion and economic earnings per share of $3.45. Our results reflect the diversity of our global business and our strategic position in attractive, return-oriented products, where we continue to see significant client demand for our affiliate strategies and the distinctive investment return streams they create.In terms of third quarter flow, we saw continued strong demand for alternatives, which included another quarter of very significant illiquid product fundraising from institutional clients, partially offset by softness in liquid alternatives in the retail channel, where investors tend to be more sensitive to short-term performance. The ongoing strength of our alternative products was partially offset by net outflows from equity strategies, driven primarily by emerging markets products and U.S. equity retail outflows.At the highest level, we were pleased with our positive organic growth in the third quarter, despite industry headwinds. We benefited from having built a diverse global business and we're pleased to see a very broad array of product types. Affiliates and geographies contributed significantly to our flow composition, as we saw strong sales across Baring Asia, BlueMountain, Capula, EIG, Pantheon, and PFM within our alternative category. [Indiscernible] Frontier and Harding Loevner were notable contributors within our equities category.Now, looking ahead, I want to address the current market environment and how we have built and continue to position our business. Obviously, it's been a volatile period. Global and U.S. equity markets have declined roughly 10% month to date as of Friday. And frankly that understates some of the underlying volatility we've been seeing. Anecdotal evidence points to some de-risking in this environment and you can see that reflected in this month's retail flow data.In the short run, this obviously creates challenges in various segments of the asset management industry. But in terms of AMG, we've been evolving the business in anticipation of more volatile and fundamentals-driven market, with the highest quality active managers proving their worth. Volatile markets underscore the need for investors to diversify their equity and fixed income exposure, especially when markets are at elevated levels. Finally, within both traditional and alternative categories, volatile markets create environment with the best active managers, like our affiliates, who can significantly outperform their benchmarks in simple passive products.Looking ahead, I would focus on three aspects of our business and strategic position. One, the diversity of the business we've built over the years. Two, the opportunities for the best active managers to outperform in this environment. And three, the quality of our affiliates and the distinctive return streams they produce.First, on the diversity of our business. Over the last decade, we have deliberately doubled the proportion of our business in alternatives from approximately 20% in the beginning of 2008 to approximately 40% of assets under management today, spread across a very diverse set of high quality alternative products, while increasing our exposure to growing parts of client portfolios at the highly active alpha end of the barbell.This evolution has come from both investments in new affiliates, as well as product innovation and development by us and our affiliates. Our alternatives business now has approximately $320 billion in assets under management, making AMG one of the largest alternative managers with one of the broadest and most diverse ranges of liquid and illiquid alternative strategies, managed by leading investors, including AQR, Baring Asia, BlueMountain, Capula, EIG, First Quadrant, Pantheon, PFM, Systematica, ValueAct and Winton.In addition, our substantial exposure to uncorrelated alternative strategies should increase the stability and resilience of our business across market cycles, while most importantly, proving attractive to clients, so increasing the long-term organic growth potential of our business.",

'AFL': "I would now like to turn the call over to Mr. David Young, Vice President of Aflac Investor & Rating Agency Relations.David Young - Aflac, Inc.Thank you and good morning. Welcome to our third quarter call. This morning, we will be hearing remarks from Dan Amos, Chairman and CEO of Aflac Incorporated, about the quarter as well as our operations in Japan and the United States. Then, Fred Crawford, Executive Vice President and CFO of Aflac Incorporated, will follow with more details about our financial results, outlook and capital management. We will then open our call to questions.Joining us this morning during the Q&A portion are members of our executive management team in the U.S., Teresa White, President of Aflac U.S.; Eric Kirsch, Global Chief Investment Officer; Rich Williams, Chief Distribution Officer; Al Riggieri, Global Chief Risk Officer and Chief Actuary; and Max Brodén, Treasurer.We are also joined by members of our executive management team in Tokyo at Aflac Life Insurance Japan, Charles Lake, President of Aflac International and Chairman, Representative Director; Masatoshi Koide, President and Representative Director; Todd Daniels, Director and Principal Financial Officer; and Koji Ariyoshi, Director and Head of Sales and Marketing.Before we start, let me remind you that some statements in this teleconference are forward-looking within the meaning of federal securities laws. Although we believe these statements are reasonable, we can give no assurance that they will prove to be accurate because they are prospective in nature.Actual results could differ materially from those we discuss today. We encourage you to look at our Annual Report on Form 10-K for some of the various risk factors that could materially impact our results. The earnings release is available on the Investors page of Aflac's website at investors.aflac.com and includes reconciliations of certain non-GAAP measures.I'll now hand the call over to Dan.Daniel P. Amos - Aflac, Inc.Thank you, Dave, and good morning, and thank you for joining us. Let me begin by saying that the third quarter 2018 concluded a great nine months for Aflac and well positioned us to achieve the goals we set for the year. As you saw from the earnings release yesterday, I am pleased that we expect to come in at the high end of the upwardly revised 2018 adjusted EPS outlook. Fred will provide more details in his comments shortly.Aflac Japan, our largest earnings contributor, generated strong financial results. In yen terms, Aflac Japan's pre-tax profit margin was ahead of expectations both for the quarter and for the first nine months.Aflac Japan's third sector sales results of a 2.6% decrease was consistent with our expectations. This reflects sales growth in our new cancer insurance and a decline in our medical insurance sales. As medical sales came-off a strong year bolstered by refresher core products, our distribution turned its focus this year on our new cancer product as they tend to do when a new core product is introduced. We expect similar results in the fourth quarter and continue to anticipate third sector new sales growth for the year to be in the low-single-digit.As I've said many times, our focus is on defending and growing our leading third sector franchise. We are indifferent as to the mix of medical and cancer sales as long as we are satisfying the needs of the consumer and our distribution partners. Regarding distribution, we had meaningful production across all channels. Traditional agencies have been and remain vital to our success.Our Alliance partners has also had significant contribution to our sales results, with such an extensive distribution network, including Japan Post 20,000-plus postal outlets selling our cancer insurance, we are solidifying our goal to be where people want to buy insurance.Our focus remains on remaining on maintaining our leadership position in the sale of third sector products that are less interest rate-sensitive and have strong and stable margins. We will continue to refine our existing product portfolio and introduce innovative new third sector products to maintain our market leadership.Turning to Aflac U.S., we are pleased with our financial performance. The pre-tax profit margins exceeded our expectations both for the quarter and for the first nine months. Our third quarter new annualized premium sales, together with our sales outlook, keep us on track to achieve the lower end of our anticipated 2018 new annualized premium sales growth of the 3% to 5% increase.As you think about U.S. sales, keep in mind that Aflac is different from our peers and that the majority of our sales come from independent sales agents. We are fortunate to have such a strong independent field force which is truly unique within our industry. These career sales agents are best positioned within the industry to reach and therefore succeed with smaller employers and groups with fewer than 100 employees.Aflac's independent career agents have been the driving force behind Aflac's ability to dominate the smaller case market. And I continue to believe this market is ours to grow. We continue to expect higher growth in broker sales. Our team of broker sales professionals has made great strides in successfully strengthening Aflac's relationship within the large broker community.",

'A': "It is now my pleasure to hand the conference over Ms. Alicia Rodriguez, Vice President Investor Relations. Ma’am, you may begin.Alicia RodriguezThank you, Brian, and welcome, everyone, to Agilent’s third quarter conference call for fiscal year 2018. With me are Mike McMullen, Agilent’s President and CEO; and Didier Hirsch, Agilent’s Senior Vice President and CFO.Joining in the Q&A after Didier’s comments will be Jacob Thaysen, President of Agilent’s Life Sciences and Applied Markets Group; Sam Raha, President of Agilent’s Diagnostics and Genomics Group; and Mark Doak, President of the Agilent CrossLab Group.I’m also please to announce that Bob MacMahon is joining us on the call today as well. As you know, he will be taking on the role as Agilent’s CFO in September due to Dider’s retirement at the end of October. You can find the press release and information to supplement today’s discussion on our website at www.investor.agilent.com. While there, please click on the link for financial results under the Financial Information tab. You will find an investor presentation along with revenue breakouts and currency impacts, business segment results and historical financials for Agilent’s operations. We will also post a copy of the prepared remarks following this call.Today’s comments by Mike and Didier will refer to non-GAAP financial measures. You will find the most directly comparable GAAP financial metrics and reconciliations on our website. Unless otherwise noted, all references to increases or decreases in financial metrics are year-over-year. References to revenue growth are on a core basis. Core revenue growth excludes the impact of currency and acquisitions and divestitures within the past 12 months. Guidance is based on exchange rates as of July 31.–––We will also make forward-looking statements about the financial performance of the company. These statements are subject to risks and uncertainties and are only valid as of today. The company assumes no obligation to update them. Please look at the company’s recent SEC filings for a more complete picture of our risks and other factors.And now, I’d like to turn the call over to Mike.Michael McMullenThanks, Alicia. Hello, everyone. Thanks for joining us on today's call. Before I discuss the Q3 financial highlights and our updated outlook I'm pleased to have Bob McMahon join the call. Bob is an excellent choice for Agilent’s next CFO and a very capable successor to Didier. Bob brings a strong track record of leadership to our team. Many of you already know Bob from his previous role of CFO of Hologics. He officially assumes the CFO role beginning September 1.As Didier hands off the baton, he will serve as adviser capacity until his retirement at the end of October. Bob and Didier working together to ensure a smooth transition. I first met Bob when in Palo Alto where we shared our perspective on business and company culture. We had an important conversation about values and the importance of business. I knew immediately that Bob would be a great fit for the Agilent culture and of course his management style and business acumen are a perfect match for our approach to trading shareholder value. Bob has joined Agilent in an exciting time. I'm confident he'll help us lead the next phase of Agilent growth.While I'm very excited to have Bob join the Agilent team I will greatly miss Didier's partnership and counsel. He has played a key role in the transformation of the company and our excellent business results. It's important for the CEO to have a very capable CFO. I couldn't have asked for a better partner. So thank you Didier. You will be missed by me and our Agilent team.Now, let me turn to our Q3 financial performance. The Agilent team delivered another strong quarter with both growth and earnings exceeding our expectations. Our core revenue grew 6% and is above the high-end of our guidance. Our adjusted EPS of $0.67 is $0.04 above the high-end of our guidance despite currency headwinds since our last guide. This is a 14% increase from a year-ago. We delivered an adjusted operating margin of 22.6%, which is an increase of 110 basis points from a year-ago. This marks our 14th consecutive quarter of improving our core operating margins.Let's take a closer look at our results by our end-markets. We continue our strong Pharma performance with 8% core growth. This is against a tough compare as we grew 10% in Q3 '17. We see strength across all our business groups with particularly strong performance in mass spectrometry, Cell Analysis, CrossLabs consumables and services and genomics. Growth remains robust in both the biopharma and small molecule market segments.Our Chemical and Energy market revenue grew 12%. We are quite pleased with this strong growth. Again, against a difficult prior-year compare of 10%. Ongoing market investment remains positive. This is in spite of tariff rhetoric and retaliatory policies you've been hearing in the news. From a product perspective strength in spectroscopy, GC, CrossLabs consumables and services is driving this result. Geographically strong gains in China and Europe are leading the overall global growth.Revenue grew 3% in academia and government inline with expectations, strong performance from Cell Analysis, molecular spectroscopy, ICP/MS and CrossLabs consumers and services are driving the results. China and the rest of Asia are delivering double-digit growth in this end-market.",